Best Online Ecommerce Merchant Account

Shopping Online Has Never Been This Easy

E-commerce merchant services have never been in higher demand. In 2020, 44% of all retail sales took place online. In 2017, e-commerce only accounted for 10.9% of retail sales. This shows that the e-commerce market is growing exponentially. In order to take advantage of the growing market, you need to make sure that you find a reputable payment processing company.

The best e-commerce account provider company is Zen Payments. Zen Payments is a pioneer of e-commerce payment processing, and we service multiple platforms to make sure you can accept credit and debit cards on any of them. If you run an online business, it is essential to work with a merchant service provider like Zen Payments that understands the online world to protect your business. When you make us your payment processing provider, we'll work with you to create a custom payment processing plan for your online business. We'll then work quickly to get your merchant account processing payments and making you money.

WHAT ARE HIGH-RISK ECOMMERCE

MERCHANT SERVICES?

Nowadays many e-commerce merchants are considered high-risk. This is largely due to the fact that chargebacks are an inherent risk anytime card not present transactions take place. Card not present or CNP transactions become high risk due to the increase in fraud, and chargebacks.

This means that many traditional payment processors won't work with your e-commerce website to provide credit card processing, a payment gateway, or other services online. Instead, you will need to obtain a high-risk merchant account and payment gateway in order to process payments for your business. A high-risk payment processor will be able to help you accept electronic payments without worrying about your payment service provider shutting you down because of a high chargeback ratio or too many returns.

CHARGEBACK PREVENTION

MERCHANT SERVICES

In the event that your business keeps growing, the risk of chargebacks continues to rise. This is why you need to make sure that you have a merchant services company that is able to constantly deliver. If your chargebacks exceed a certain threshold, you may be at risk to have your funds frozen, and your merchant account terminated. The last thing you want to worry about as a business owner is not having access to your funds.

ECOMMERCE PAYMENT

PROCESSING INTEGRATIONS

When processing online payments, e-commerce merchants need to take proactive steps in order to protect their clients. The first step is to make sure that your e-commerce business is safe for customers to use when selecting the appropriate platform for your website. This is especially true if you are a high-risk merchant. Setting up a high-risk merchant account will be key to integrating with your chosen platform. Our e-commerce payment processing tools integrate seamlessly with:

BigCommerce

BigCommerceBigCommerce is one of the best platforms for e-commerce businesses that need a user-friendly, all-in-one hosting, web building and design solution. Customers enjoy the streamlined, hassle-free checkout process that saves time.

Chargebee

ChargebeeIf you run a subscription-based e-commerce business, Chargebee gives you the flexibility to experiment with multiple pricing structures, product catalogs and subscription life cycles. It also works with your revenue stack to help you manage payments and sales more efficiently.

Chargify

ChargifyZen Payments can also provide e-commerce merchant processing through Chargify, a leader in event-based billing solutions. Chargify is compatible with one-time, recurring, quantity-based, prepaid and usage-based scenarios.

ClickFunnels

ClickFunnelsWe're one of the best e-commerce merchant services for ClickFunnels users. This platform enables you to create sales funnels to help you convert your site's visitors into buyers.

Konnektive

KonnektiveOne of the world's most powerful CRMs, Konnoktive offers effective e-commerce solutions for straight sales, subscription billing, one-click upsells and much more. It's compatible with custom-built websites or when using a site-building tool and hosting service.

Recurly

RecurlyThe Recurly billing platform simplifies subscription management via technologically advanced automated processes. You'll be able to grow your subscriber lists nationwide and globally while delivering superior service.

Shopify

ShopifyAs leading a Shopify high-risk debit and credit card payment processor, Zen Payments can help you utilize this highly popular e-commerce platform to maximize your business's potential and manage your day-to-day more efficiently.

WooCommerce

WooCommerceWooCommerce is a WordPress-compatible open-source plugin that's customizable and easy to install. We can provide a WooCommerce high-risk payment gateway that enables you to process customer transactions quickly and securely.

Once you have your platform, you will need to set up an SSL certificate. This will protect your site from 3rd party security breaches and keeps the customer's information safe. The last step you'll need is to make sure that you are PCI compliant. For more information, you can see the checklist here.

VIRTUAL TERMINAL

SERVICES

Don't have a website? No problem! We offer a proprietary virtual terminal that allows you to manually key in your client's billing information. Our virtual terminal also allows you to enroll clients in recurring plans, validate AVS and CVV responses, send invoices, and generate detailed reports. This is the perfect solution for those who have already been doing business, but maybe that new website is still under construction.

Zen Payments is a payment processor that can help! We want our e-commerce merchants to be able to process payments without hesitation, and being able to adapt to any situation is something that makes us cutting-edge. To learn more about our virtual terminals give us a call today!

HIGH-RISK MERCHANT

ACCOUNT INDUSTRIES

These days, virtually every business that sells products must have an easy-to-use e-commerce platform to stay competitive and meet customer demands. Whether you operate online exclusively or use e-commerce to support a brick-and-mortar operation, you can trust Zen Payments to serve your needs.

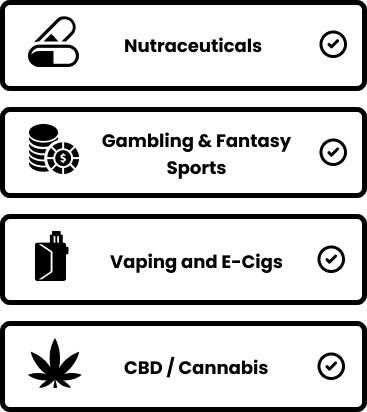

We can serve online merchant accounts in the USA and abroad for businesses in high-risk industries such as:

- Nutraceuticals

- Gambling and Fantasy Sports

- CBD/Cannabis

- Vaping and E-Cigs

If your e-commerce business falls in one of these industries, you'll need a high-risk merchant account to provide payment processing solutions, including a payment gateway. Otherwise, you'll be unable to accept credit and debit card payments. That's where we come in! Zen Payments is the best high-risk merchant account provider in the industry, and we'll work with your e-commerce business to get your site ready to accept credit card payments.

WHY CHOOSE ZEN PAYMENTS AS YOUR MERCHANT

ACCOUNT PROVIDER

At Zen Payments, we are experts in the payment processing solutions industry and have over 15 years of experience with e-commerce businesses. When you set up an e-commerce merchant account with us, you can rest easy knowing you are working with a company that understands the merchant account services world inside and out. We'll get you set up quickly, even if you are in a high-risk category. You'll be accepting debit and credit card payments within a couple of weeks.

We also recognize that high-risk e-commerce businesses like yours aren't always treated kindly by other payment processing service providers. While many of these operations won't even consider working with companies in your industry, we welcome your business. We care about every customer, and we understand the unique challenges you face every day. You have enough on your plate with trying to fulfill your customers' needs and grow your business. We'll remove the burden of payment processing from your shoulders.

Need a merchant

Account?

If you're seeking a payment processing platform that can positively impact your business, Zen Payments is here to assist. Get started today by contacting us online or calling our merchant services specialists at 877-715-4501. We'll get you approved quickly so you can accept online payments within a couple of days.

Apply NowFrequently Asked Questions

With Zen Payments, merchants can accept a wide range of payment methods, including:

- Credit and debit payment cards

- Digital wallet options such as Apple Pay and Google Pay

- Contactless payment methods

- Mobile checkout via smartphone, mobile device, and QR code scanning

These options give customers flexibility when buying during online shopping and enhance the user experience.

There are several types of processing fees ecommerce merchants typically pay:

- Interchange Plus fees: interchange fees charged by card networks like Mastercard and an additional fee for the services of your payment processing company OR a Flat Rate Fee: for every transaction the merchant pays the same fee to the payment processor

- Monthly Account Fees (Zen Payments doesn't charge Monthly account fees)

- Setup Fee (Zen Payments also doesn't charge a setup fee)

Zen Payments works to keep price, cost, and overall expenses competitive so businesses can find affordable credit card processing for their business' needs.

Yes. Zen Payments integrates with:

- Magento

- Shopify

- Wordpress's Woocommerce

- Certain payment terminals, card readers, and point of sale systems

This allows businesses to unify brick and mortar and ecommerce operations while managing payments through a single provider.

Ecommerce merchants often need more than just payment processing. Zen Payments supports tools and integrations for:

- Customer relationship management (CRM)

- Accounting software

- Payroll

- Inventory management

Together, these help simplify operations, optimize reporting, and improve workflow efficiency.

Yes. Zen Payments enables ecommerce merchants to accept:

- Online payments through our website or cart

- In-person payments using payment terminals, card readers, and point of sale devices

- Mobile payment options through smartphone and mobile device interfaces

This versatility helps ecommerce businesses expand into brick and mortar retail if desired.

Absolutely. Zen Payments supports mobile-first operations using:

- Smartphone apps

- Android checkout tools

- Mobile interface solutions

- QR code payments

This flexibility helps merchants capture sales on any device and deliver a modern shopping experience.