Whether you’re the business or the customer, you understand this age-old agreement — a customer gives a business money in return for an agreed-upon product or service. Every business owner wants each transaction to be as smooth as possible, and in a perfect world, they would be. But the reality is this exchange of money for products or services will sometimes go differently than planned by both parties.

When a sale leaves the customer dissatisfied for any reason, they have a few courses of action they can take to reach satisfaction. The two most common responses are refunds and credit card chargebacks. In this article, we’ll take a closer look at what a credit card chargeback is, why you want to avoid them and what you can do to minimize the occurrence of a chargeback.

WHAT IS A CREDIT CARD CHARGEBACK?

A credit card chargeback involves a customer going directly to the bank to get their money back after a merchant transaction. When a customer is dissatisfied with what they purchased from you for whatever reason, they’ll seek any path possible to get their money back. In the case of a chargeback, they’re asking for a reversal of a payment as opposed to a refund from the merchant itself.

When a customer pursues a credit card chargeback, they reach out to their bank for remediation. This action causes the bank to forcibly take the money from your account to appease the customer. For this reason, many businesses are unaware that chargebacks are occurring until after the customer has done the deed. This scenario can lead to some negative consequences.

REFUNDS VS. CHARGEBACKS

It’s important for you to know that chargebacks and refunds are two separate events. At first glance, you may think that chargebacks are harmless. After all, the customer has the right to get their money back in many situations — you may have heard the old adage, “The customer is always right.” Whether the customer is actually right or wrong, chargebacks can have serious detrimental effects on your business.

Both business owners and customers have plenty of experience with refunds. On the business side of things, you’ve probably carried out several refunds to customers to make right by them. When you play the role of the customer outside of work, you’ve probably made plenty of return trips to the store to get your money back because of a malfunction or you bought the wrong item. There are many reasons to make a refund — and usually, these interactions end amicably.

A chargeback is different from a refund in that the customer demands their money back from the bank, cutting you out of the appeal. A customer may choose to pursue a chargeback for many reasons, including the following:

- The merchant is unwilling to cooperate with the customer’s refund request.

- The customer is looking for a quicker process, so they go to their bank for a chargeback instead of seeking a refund.

- The customer feels the more “separated” approach to chargebacks will allow them to give fewer details about the nature of their complaint with your product or service.

Ultimately, chargebacks exist so that customers can have protection or a fallback when dealing with bad merchants. Unfortunately, many customers — whether they do it subconsciously or on purpose — abuse their ability to demand a chargeback. This has caused many good businesses to experience repercussions from the banks, often unfairly.

There should be a balance of respect between businesses and their customers so that when transactions go the wrong way, both parties can be happy at the end of the day — and typically, a refund can make that happen.

WHY ARE CHARGEBACKS BAD FOR YOUR MERCHANT ACCOUNT?

It’s crucial to limit the number of chargebacks that occur on your merchant account to the smallest number possible. Here are a few of the reasons why chargebacks are so bad for your business’s merchant account:

- Penalties and fees: When you experience a chargeback, you’ll have to pay the bank more than the amount being returned to the customer and an extra bank-issued penalty on top of that. This extra fee can be detrimental to any business’s overhead costs, especially small businesses.

- A higher chargeback-to-sales ratio: The banks will know how many chargebacks your merchant account has compared to the number of regular, completed sales you make. If the ratio gets too high, the bank could label you as a “high-risk” business. In that case, you may experience some consequences to your merchant account, including higher bank costs and even losing your merchant account.

- Increased bank costs per transaction: Once the bank deems you “high risk,” it can be hard to get your good reputation back. The bank will start treating you differently when you use bank cards or conduct e-commerce transactions. In fact, you may have to start paying the bank more money per transaction for use of their bank card services.

- A loss of your merchant account: In the worst-case scenario, you could completely lose access to your merchant account. This usually occurs once the bank views you as too high-risk to work with any longer, like if your chargeback to sale ratio gets too high. When that happens, you’ll lose the ability to use debit or credit cards at your store or conduct e-commerce.

CAN YOU GET CHARGEBACK PROTECTION?

Fortunately, you can get chargeback protection by partnering with the right merchant account provider.

One reason chargebacks are so dangerous is that most businesses are unaware they’re even happening until many days after the customer has filed the request with the bank. This delay puts businesses at a severe disadvantage. Though businesses have the right to fight back or contest an alleged chargeback, a delay in awareness can cause a business to miss its window of opportunity. Then, it has to pay back the charge and fees and deal with a reduced reputation in the eyes of the bank.

As a business owner, you deserve the peace of mind to know you can always accept bank cards to complete your transactions. Alongside getting a reliable merchant account, partnering with a chargeback protection specialist will keep your merchant account up and running and persuade the banks to let you use bank cards, even if they see you as a high-risk business.

This type of protection can be a lifesaver for any sized business. With the right chargeback protection program, you can see a chargeback before the bank and before the customer completes the process. This provides you with valuable time to reach out to the customer to try to solve the problem without a chargeback. As a result, you’ll have the opportunity to make things right, which can keep your chargeback numbers down and keep you processing bank cards in the future.

HOW TO PREVENT CHARGEBACKS

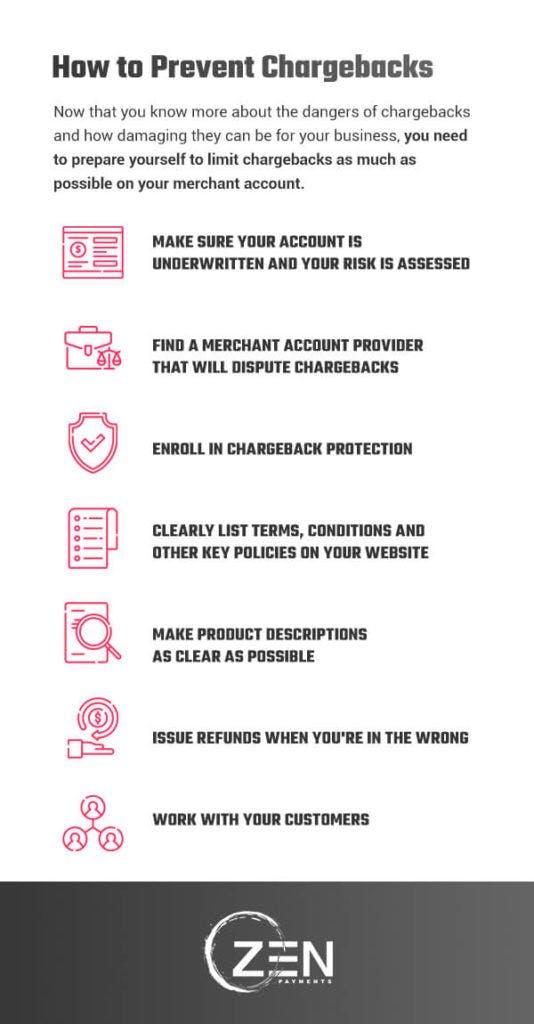

Now that you know more about the dangers of chargebacks and how damaging they can be for your business, you need to prepare yourself to limit chargebacks as much as possible on your merchant account. Here are some of the ways you can accomplish that.

1. MAKE SURE YOUR ACCOUNT IS UNDERWRITTEN AND YOUR RISK IS ASSESSED

Underwriting your account ensures people know your business. When an outside entity underwrites your business, they’re making sure you are who you say you are to reduce any chance of fraud. This process is the important first step toward achieving chargeback protection and maintaining access to bank card transactions.

Additionally, make sure your merchant account is risk assessed. The bank may view you as high-risk and unleash strict mandates against you, but an accurate risk assessment from a chargeback protection company can give you a chance of returning to some level of normalcy. With a risk assessment, you can prove you’re still able to safely process bank card transactions in your merchant account.

2. FIND A MERCHANT ACCOUNT PROVIDER THAT WILL DISPUTE CHARGEBACKS

When it comes to the banks, you sometimes need to put up a bit of a fight to protect your business’s reputation. It’s a fact that banks favor customers in most chargeback requests, but the truth is that the customer isn’t always right. There’s a chance to contest and reverse every chargeback.

Make this process easier by hiring a merchant account provider that will dispute chargebacks on your behalf. Dealing with the banks can be difficult and could take some finesse. The right merchant account provider will handle that side of things for you so you can put your focus back on your business — where it belongs.

3. ENROLL IN CHARGEBACK PROTECTION

One of the most important parts of protecting your business’s reputation in the eyes of the banks is enrolling in chargeback protection. As mentioned, chargeback protection gives you the ability to see potential chargebacks before they show up in your merchant account. Then, you can reach out to the customer and treat the exchange as a second chance to gain the customer’s trust and seek a way to solve the issue without a chargeback.

Without chargeback protection, you may be unaware that a chargeback is even processing until it’s too late. Then, you’ll have to suffer the consequences of a higher chargeback-to-sale ratio, which can lead to penalties, fees, and even a loss of your merchant account. Give yourself a better chance at avoiding these negative consequences with the help of a chargeback protection program.

4. CLEARLY LIST TERMS, CONDITIONS AND OTHER KEY POLICIES ON YOUR WEBSITE

A top contributing factor that can lead to a chargeback is unclear information on your website. Some customers may assume your return policy is one way when it’s actually entirely different. Then, when a customer learns that your refund policy is different than they expected, they may go straight to the bank and demand a chargeback.

For this reason, you must clearly list all terms, conditions, and other key policies on your site for your customers. Providing clear policy information can help your customers know what they’re getting into before making a purchase, which can reduce the number of chargebacks you encounter. Plus, if a customer tries to get an unfair chargeback, having clear policy rules on your website gives you a stronger case for reversing it.

5. MAKE PRODUCT DESCRIPTIONS AS CLEAR AS POSSIBLE

Along the same lines as the tip above, you want to make your product descriptions as clear as possible. Clarity on your website is key to increasing confident customer purchases and reducing the number of chargebacks that occur.

With clear product descriptions, your customers will know exactly what they’re getting before they click “buy now.” Confident customers translate to smarter purchases, which will help you achieve a better chargeback to sale ratio. Reduce chargebacks by engaging in best practices before the sale even happens.

6. ISSUE REFUNDS WHEN YOU’RE IN THE WRONG

Always issue a refund to your customer when you’re indeed in the wrong. There will be times when your product malfunctions or something similarly unexpected happens. In these instances, the negative outcome was out of the customer’s control, so it’s important to honor that.

These events will also happen regardless of how clear your wording was on your website. As a reputable business, you must accept the reality that accidents happen, and you need to value and respect your customer enough to issue the refund when they ask for one within the parameters of your return policy. Remember, a refund is always better than a chargeback.

7. WORK WITH YOUR CUSTOMERS

Another great way to reduce the number of chargebacks you experience is by working with your customers. Be accommodating. Do your best to make your customers happy time and time again. And while this may be hard, sometimes keeping your customer happy and avoiding a chargeback means taking a loss.

In rare instances, you may have to issue a refund even though you know you’re in the right. Doing this shows you care about your customer’s future business and that you’re willing to put the customer’s satisfaction first. When you take this loss, think of it as actually taking the win — you’re avoiding a potential chargeback. Plus, you may have secured your next sale if your customer is happy with your treatment of them.

ZEN PAYMENTS CAN PROTECT YOUR MERCHANT ACCOUNT FROM REPUTATION DAMAGING CHARGEBACKS

At Zen Payments, our goal is to provide honesty, flexibility, and transparency to every one of our clients. We’re here to help protect your merchant account from chargebacks, and we’ll stand up for your rights and dignity as a business if one does occur. With our help, you can have peace of mind knowing your merchant account is in good hands — even if the banks consider your industry high risk.

Contact us online today to get in touch with our caring and professional team or call us at 801-405-9888 to speak with a representative. We’re ready to help you get back to focusing on running your business. We’ll handle your merchant account so you can keep the transactions coming in and your profits increasing.

We look forward to serving you!