One common dilemma in retail is that businesses don’t want to make refunds, but customers don’t want to make purchases with no reassurance, either. If you opt for strict or nonexistent refund policies, you’re probably doing yourself a disservice, as you could be deterring customers, hurting your reputation or increasing your chances of forced refunds via chargebacks. Compromising with your customers can often help you avoid these pitfalls.

Let’s take a closer look at how refunds affect businesses and what you can do to find a middle ground between a no-refund policy and a free-for-all.

Pros and Cons of a No-Refund Policy

The first solution you might consider if you want to avoid the hassle of returns is to simply deny refunds overall. It may sound tempting upfront, but these policies are often restricting and can lead to more costs in the long run. They’re also a key part of customer satisfaction and will significantly influence how eager people are to buy from you.

How do refunds affect your business? Some of the pros of a no-refund policy include:

- Keeping your money: Of course, you won’t need to give back any funds, keeping your bottom line unaffected once the purchase goes through. This choice also saves you money on the processing fees that some payment processors may keep when issuing refunds.

- Less work: Not accepting refunds reduces the need for a robust customer service team. As a result, you may be able to save on labor and the overhead required to process refunds and returns.

Meanwhile, the cons of not offering refunds include:

- Fewer sales: A strict refund policy is often a deterrent. If customers don’t feel confident in their purchase, they’re more likely to pass it up. If your product is offered at other retailers, they have several other options. Lenient return policies offer more of an increase in sales than returns. The increase in sales is often enough to outweigh the additional cost of processing returns.

- Hurting your reputation: Customers that have unpleasant experiences often discuss it with friends and post about it online. There’s no denying that word of mouth travels fast and has a lot of power, and reviews are essential when a customer is trying to make up their mind about you. Not offering refunds can easily upset customers who aren’t happy with their purchase, spurring negative reactions and causing them to not return to your store.

- Potential legality problems: Some countries and states don’t allow for blanket no-refund policies. They might have minimum requirements, such as a three-day policy. If you work across borders, you’ll need to look into the legality of not offering refunds.

- Payment processor requirements: Some payment processors ask their clients to offer longer return policies to reduce the chances of chargebacks that come from customers unhappy with not being offered any recourse. If you don’t offer a return option, you might be limiting your partner options.

Ultimately, it depends on your business landscape and your goals. For most merchants, it makes sense to offer at least some type of refund policy.

Mutually Beneficial Refund and Cancellation Policies for Businesses

Of course, offering a return policy doesn’t mean taking back everything without any stipulations. It’s crucial to create a policy that’s advantageous for both parties. While customers should feel reassured that they aren’t out of luck if things don’t work out, you should be able to know that customers won’t get to take advantage of you. There are many steps you can take to minimize the chance of returns in the first place.

Let’s look at making the policy first. Below are some things to consider when building your return and cancellation policies:

- Item types: Consider if specific items will qualify for different return requirements. Items like media, digital products and consumables may not be returnable due to legal restrictions. Additionally, sale or clearance items might also be excluded from returns. Be sure to include these in your policy.

- Visibility: A return policy should be easy to access and understand. Post yours prominently on your website and in various locations in physical stores. Include it on receipts and emails. Use clear, definitive language.

- Circumstances: If you choose to have a more restrictive policy, be sure to provide your customers with reassurance for events that are out of their control. If the customer receives a damaged item or you send them the wrong one, they’ll expect a refund or a replacement.

- Customer-centered language: When writing up the policy, frame it as being customer-centered. Tell them why you have your policies in place. A clothing retailer might say that they don’t want to run the risk of selling products that have been worn, while someone selling food items can communicate how the policy is for safety purposes.

- Reminders: If your customers have signed up for a recurring purchase or subscription, be sure to send out a reminder email before the renewal date. It’s also a good idea to offer refunds within a certain amount of time because many people forget about these and become angry if charged without notice. Upsetting customers with these practices is a good way to stop them from coming back.

Return policies can vary in their leniency by timeframe, type of item and requirements, such as needing the original receipt or tags. Merchants can also be more or less lenient in how they refund the purchase. They might choose to provide only a partial refund or exchanges, rather than full refunds. Lenient policies can both boost sales and improve the customer experience.

You might be worried that lenient policies will increase the number of refunds, and that’s possible, but there are several steps you can take to minimize that chance. It generally requires being proactive and delivering solutions prior to the purchase. Consider offering free trials or samples, so customers can try the item risk-free, or creating buying guides and detailed sizing information. These resources can help customers make an informed purchase and better understand the product.

Another key part of the returns process is your customer service. It should be easy for customers to get in touch with your team, which may be able to offer alternatives or simple fixes. Make sure representatives have solutions available and don’t make the situation difficult.

Refunds vs. Chargebacks — What's the Difference?

While both refunds and chargebacks result in the payment getting sent back to the customer, refunds are much more preferable. Chargebacks occur when the customer disputes a charge with their credit card issuer or payment processor and the transaction is reversed for a forced refund. If a customer submits a chargeback, the merchant needs to send in a rebuttal and go through the dispute process to try and get the money back. Even if they win, the chargeback has significant downsides for the merchant.

Chargebacks often come with additional fees, and too many of them will cause your chargeback ratio to rise, which could even result in being denied a merchant account by many payment processors. If you lose the chargeback, you might be out of the cost of the item or service, along with the refund that goes to the customer and any additional fees that come with the process. A refund is always preferable to chargebacks.

It’s especially important to avoid chargebacks if you’re in a high-risk industry. These organizations, such as those selling firearms, CBD or travel or credit repair services, already tend to have a harder time working with payment processors that may charge higher fees or deny them due to their high-risk status. A high chargeback ratio simply adds to the risk associated with a business.

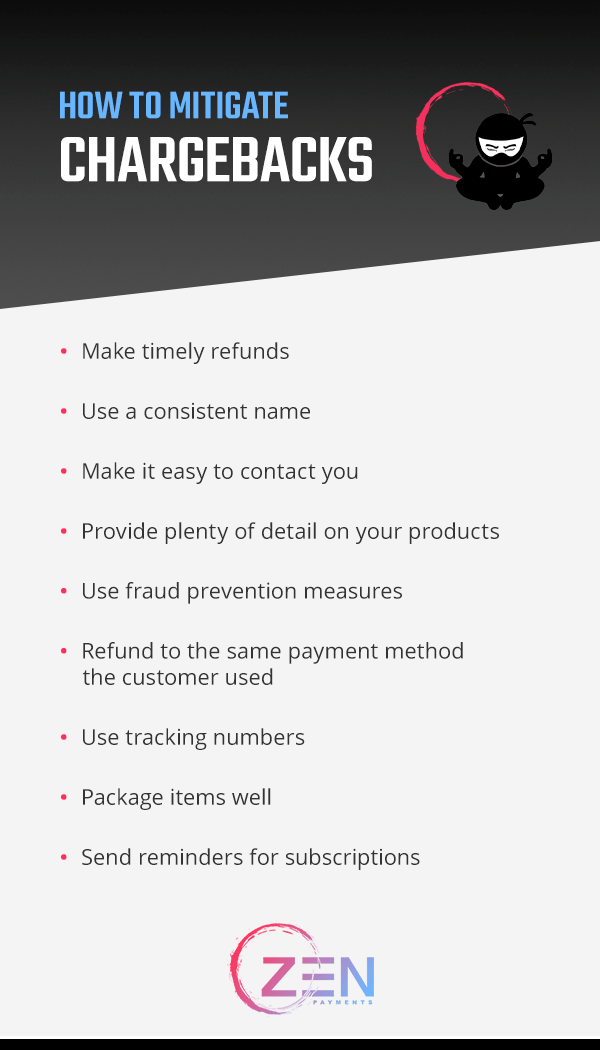

How to Mitigate Chargebacks

Offering refunds is one of the best ways to avoid chargebacks. Still, it isn’t a catch-all. Even if you do have a lenient return policy, chargebacks can come from many sources, such as customers not recognizing the transaction on their statement or not being able to reach your customer service team.

While providing refunds can help reduce chargebacks, reducing chargebacks also helps you find the peace of mind to widen your return policy, since you can reduce the possibility of fraudulent refunds and minimize the costs associated with chargebacks.

Some strategies for mitigating chargebacks and perfecting refunds for businesses include:

- Make timely refunds: If you take too long, customers may get impatient or think that their refund isn’t coming and report the transaction to their card issuer. Be sure to communicate the timeframe to the customer and tell them how long they can expect before it shows up in their account.

- Use a consistent name: Your doing business as (DBA) name should be consistent across your website, in-store locations and banking accounts. If a customer sees an unfamiliar name on their statement, they might not recognize the transaction and dispute it. Try to get your phone number included with payment processors, too, so customers see it and call you before reaching out to the card issuer.

- Make it easy to contact you: Getting in touch with your customer service team shouldn’t be a hassle. It should be easy to find your phone number or email and initiate the return or cancellation process. Consider adding a live chat feature for another easy mode of contact.

- Provide plenty of detail on your products: By making sure your descriptions are detailed and accurate, you can improve your customers’ understanding of the products and limit the chance of a return. Sizing information and specifications are always useful to include.

- Use fraud prevention measures: Payments should require expiration dates and card verification values (CVVs), and you’ll want to conduct address verification during checkout. While these steps won’t reduce returns, they provide you with the proof you’ll need to fight fraud claims.

- Refund to the same payment method the customer used: Always use the same method of payment for returns. This ensures that the customer and card issuer can both see the initial transaction and the refund. If you give them cash or put the refund on another card, the customer could say that they didn’t receive the refund. This could also occur when someone other than the purchaser makes the return, trying to pocket the cash.

- Use tracking numbers: Customers often claim that their products didn’t arrive when they actually did. Alternatively, if your shipping takes longer than most, customers might think that the package never showed. Tracking numbers allow them to keep an eye on things and gives you proof when the product arrives — some carriers even take photos on delivery. Giving customers their tracking numbers upfront can also help reduce calls to customer service.

- Package items well: To prevent problems in shipping, make sure you package items well. Fit your boxes to your products and use bubble wrap where necessary to protect items from being tossed around while they’re in transit.

- Send reminders for subscriptions: If you offer recurring subscriptions, send out reminders ahead of time. These will help your customers make cancellations before the renewal date instead of filing for a chargeback.

No matter what you do to prevent chargebacks, it’s a good idea to track and learn from them. Monitor your chargebacks and try to collect information about which banks or products are most likely to cause them. Maybe a product description is inaccurate or a certain bank likes to see a piece of information you haven’t been including in rebuttals. Look at things like marketing and signage, too. Your social media team may have put out a sign that’s worded poorly, bringing in a slew of confused customers.

Another great way to mitigate the effects of chargebacks is to work with a high-risk merchant account. These accounts are designed for businesses with high numbers of chargebacks or that work in high-risk industries such as credit repair, CBD or adult products or services. Too many chargebacks and refunds can hurt your relationships with some banks and processors, but high-risk accounts don’t punish you for these occurrences. We don’t stop doing business with you just because you tend to get chargebacks.

Prevent Chargebacks and Widen Your Return Policy With Zen Payments

By giving your customers the chance to solve their problems with you instead of their bank, you can do yourself a lot of favors. At Zen Payments, we understand that being labeled high-risk shouldn’t get in the way of how you run your business, such as how you take returns. That’s why we work with a wide network of banks to offer processing solutions and chargeback protections for these types of organizations.

Our high-risk merchant accounts offer affordable, secure payment methods, so you get more freedom and options for keeping your customers happy. Grow your business by partnering with the experts in high-risk merchant accounts. Whether you work online or in person, we can help you set up the right solutions, all backed by 24/7 support. To learn more about working with Zen Payments, reach out to us online.